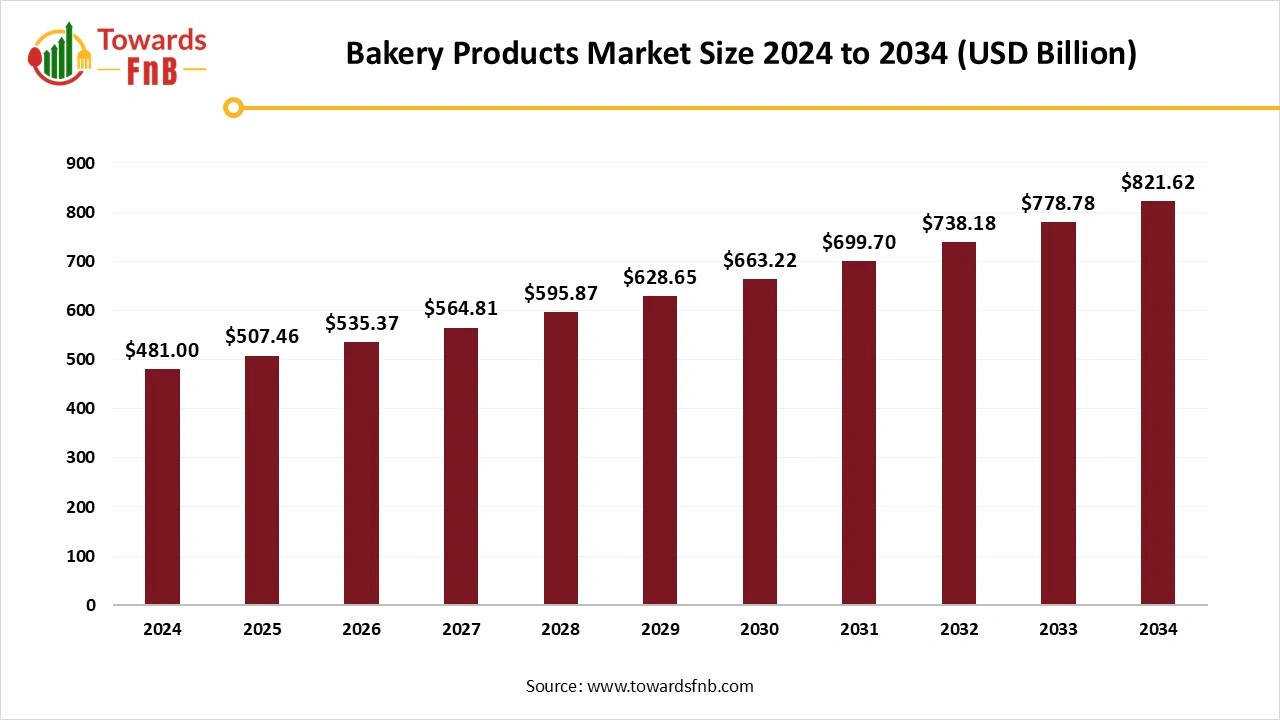

Bakery Product Market Size to Worth USD 821.62 Billion by 2034 | Towards FnB

According to Towards FnB, the global bakery product market size is calculated at USD 507.46 billion in 2025 and further advance to USD 821.62 billion by 2034, reflecting at a CAGR of 5.5% from 2025 to 2034. The market is experiencing growth driven by high demand for organic, low-sugar, and clean-label bakery products among consumers of all ages. Higher demand for convenient and organic food options is another major driver of market growth.

Ottawa, Oct. 29, 2025 (GLOBE NEWSWIRE) -- The global bakery product market size stood at USD 481 billion in 2024 and is predicted to increase from USD 507.46 billion in 2025 to USD 821.62 billion by 2034, according to a report published by Towards FnB, a sister firm of Precedence Research.

As health consciousness and sustainability continue to shape global food consumption, the bakery sector is witnessing notable transformation,” said Vidyesh Swar, Principal Consultant at Towards FnB. “Brands that adapt their portfolios toward functional, low-sugar, and clean-label bakery products are expected to achieve long-term competitive advantages.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5493

Key Highlights of Bakery Product Market

- By region, Europe led the bakery product market in 2024, whereas the Asia Pacific is expected to grow in the foreseeable period.

- By product, the bread segment captured the maximum share in 2024, whereas the biscuit and cookies segment is expected to grow in the foreseeable period.

- By distribution channel, the supermarket and hypermarket segment led the bakery product market in 2024, whereas the convenience stores segment is expected to grow over the forecast period.

- By product range, the conventional segment led the bakery product market in 2024, whereas the specialty segment is expected to grow in the foreseeable period.

- By form, the fresh segment led the market in 2024, whereas the frozen segment is expected to grow in the foreseen period.

Higher Demand for Freshly Baked Products is helping the Expansion of Bakery Products.

Higher demand for health-conscious, convenient, and artisanal options is a major factor driving the growth of the bakery product market. Convenient food options are highly demanded today as they help save time. Hence, they are highly sought after by consumers across different age groups. Consumers are also concerned about the ingredient list of the options available in the market.

Hence, this further fuels the demand for organic and clean-label products. Health, nutrition, and other related factors are also major drivers of market growth. Hence, bakery products such as breads, pastries, cookies, and cakes, with reduced or no sugar, are in high demand among consumers, further fueling the growth of the bakery product market. Consumers are also seeking a variety of products made with whole grains, less sugar, probiotics, and fiber for a healthy gut and greater nutrition.

Government Initiatives for the Bakery Industry Globally

- India- Programs such as ‘Production Linked Incentive Scheme for Food Processing Industry’ and schemes such as the ‘PM Formulization of Micro Food Processing Enterprises (PMFME) ' help the growth of the industry in India. Such programs and schemes help smaller businesses grow and contribute to market growth. (Source- https://share.google/Eqz8eCN5Eb7Q2aRLd)

- Europe- The EU’s strategy focuses on promoting sustainable food policy through sustainable practices and methods. The region's Sustainable Wheat Initiative aims for net-zero emissions by 2050. (Source- https://www.sustainablewheatinitiative.eu/about/)

-

US- the FDA proposed food labeling guidelines in 2025, including clear information about the nutritional value of the product for the glance of consumers. (Source- https://share.google/8pT5qYNF23KEnheUK)

New Trends in the Bakery Product Market

- Higher demand for organic, vegan, and plant-based dairy and bakery options fuels the growth of the bakery product market.

- Higher demand for specialty products with functional ingredients such as chia seeds, protein, and oats also helps to fuel the growth of the market.

- Health-conscious consumers in search of gluten-free, organic, clean-label, and no-sugar options are driving market growth.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/bakery-product-market

Impact of AI on the Bakery Product Market

Artificial intelligence (AI) is rapidly transforming the bakery products market, driving innovation, precision, and efficiency across production, supply chains, and consumer engagement. Traditionally, bakery operations relied heavily on manual skill and fixed recipes, but AI is now enabling data-driven decision-making that improves both product quality and profitability. In manufacturing, AI-powered systems equipped with smart sensors and computer vision can monitor key parameters such as dough texture, fermentation, baking temperature, and product color in real time. These systems automatically adjust oven settings or ingredient ratios to ensure consistent results, reducing waste and maintaining the uniformity required for large-scale production and exports. This consistency is vital for global trade, as bakery products must meet strict quality and safety standards across different regions.

AI is also reshaping product innovation and formulation in the bakery sector. By analyzing consumer data, flavor trends, nutritional needs, and ingredient interactions, AI tools can develop new recipes and reformulate existing ones to meet changing market demands. For example, global ingredient suppliers like Puratos have begun using AI to analyze sensory data and social media trends to design pastries, breads, and cakes tailored to regional tastes or dietary preferences, such as gluten-free, vegan, or low-sugar variants. This allows bakeries to innovate faster and target niche markets, a key advantage in international trade where localizing flavors for different cultures can significantly boost market entry success.

Recent Developments in the Bakery Product Market

- In June 2025, the Karnataka Milk Federation (KMF) launched a new line of bakery products under the Nandini Goodlife brand. The new launch line includes 18 varieties of muffins, cakes, and bar cakes. (Source- https://www.newindianexpress.com)

- In September 2025, Meala FoodTech, a food tech innovator, launched a clean-label and single-ingredient pea-protein that will replicate the multi-functional performance of eggs in bakery products. It will help manufacturers to reduce costs and also reduce the dependence on unstable egg supplies. (Source- https://nutraceuticalbusinessreview.com)

Bakery Product Market Dynamics

What are the Growth Drivers of the Bakery Product Market?

Factors such as rising disposable income, higher demand for healthier bakery items, and the availability of such products easily on different platforms are some of the major factors for the growth of the market. A few bakery products are a part of consumers’ daily lives. Hence, they are manufactured in bulk and consumed on a large scale, which supports market growth. The availability of clean-label and organic products also fuels market growth. Health-conscious consumers form a huge base for the market to enjoy bakery items without any guilt. Hence, they also have a major contribution to the growth of the bakery product segment.

Challenge

Rising Raw Material Prices Affecting the Growth of the Market

The bakery industry relies heavily on raw materials such as wheat, sugar, and dairy. The fluctuating supply of these products hampers the market's growth significantly. Higher raw-material prices result in higher costs for final bakery items as well. Hence, the market loses its base of price-conscious consumers, affecting its growth.

Opportunity

Healthier Bakes are Helpful to Elevate the Growth of the Market

The rising number of health-conscious consumers seeking healthier alternatives is a major opportunity for the bakery product market. High demand for organic and clean-label products is expected to drive market growth in the foreseeable future. Higher demand for whole wheat, gluten-free, and no-sugar options also supports market growth among health-conscious consumers. Higher demand for frozen products such as frozen doughnuts, croissants, or chocolates also helps drive market growth, as they have a longer shelf life and can be consumed easily outdoors.

Product Survey – Bakery Product Market

| Product Category | Description & Market Insights |

| Bread & Rolls | Bread remains the largest segment of the bakery market, accounting for a major share of global sales. It includes white bread, whole grain, multigrain, sourdough, and specialty rolls. Rising health consciousness has driven demand for fortified, gluten-free, and high-fiber varieties. Innovation in artisan and clean-label breads is enhancing premiumization within this category. |

| Cakes & Pastries | This segment covers packaged cakes, muffins, cupcakes, and pastries. Growth is driven by indulgence, convenience, and innovation in flavor and texture. Premium offerings such as mousse cakes and gourmet pastries are increasingly popular, while smaller portion sizes cater to calorie-conscious consumers. |

| Cookies & Biscuits | A major global segment known for its versatility, spanning sweet, savory, sandwich, and functional cookies. Health-oriented variants, such as high-protein, sugar-free, and multigrain cookies, are gaining momentum. Brand innovations in gluten-free and vegan cookies are broadening the appeal across demographics. |

| Frozen Bakery Products | Includes frozen bread, croissants, dough, and pizza bases designed for foodservice and retail convenience. Frozen bakery items are growing rapidly due to longer shelf life, minimal waste, and ease of preparation, particularly in hotels, restaurants, and cafés (HoReCa). |

| Doughnuts & Sweet Buns | Popular across both retail and QSR channels, this segment benefits from flavor experimentation and limited-edition product launches. Premium and filled doughnuts, often featuring local and seasonal ingredients, are trending among younger consumers. |

| Pies & Tarts | Includes sweet and savory pies made from fruits, meats, and vegetables. Demand for pre-packaged and ready-to-bake pies has increased, especially in North America and Europe. The introduction of vegan and low-sugar fillings is reshaping this traditional category. |

| Croissants & Viennoiserie | A premium and indulgent bakery sub-segment experiencing strong growth globally. Ready-to-bake croissants and laminated dough products are favored by the hospitality and frozen food industries for their convenience and consistency. |

| Artisan & Specialty Bakery Products | Characterized by handcrafted and small-batch production, this category focuses on authenticity, traditional techniques, and locally sourced ingredients. The trend toward artisanal bakery goods reflects consumer interest in quality, freshness, and clean-label production. |

| Savory Bakery Products | Includes bakery snacks such as cheese sticks, stuffed rolls, quiches, and savory pies. The fusion of traditional bakery formats with regional cuisines and spices is fueling product diversification. |

| Gluten-Free & Functional Bakery Products | A rapidly growing niche addressing dietary restrictions and wellness trends. These include gluten-free, keto, and protein-enriched baked goods formulated with alternative flours like almond, oat, and rice. Functional bakery innovations, such as added probiotics or plant proteins, are expanding their mainstream appeal. |

| Ethnic & Regional Bakery Products | Includes region-specific bakery items such as baguettes (France), naan (India), bagels (North America), and pandesal (Philippines). Globalization and food tourism are driving cross-regional demand for traditional and ethnic bakery experiences. |

| Ready-to-Eat (RTE) Bakery Snacks | Combines bakery and snack concepts, offering on-the-go convenience. Products like breakfast bars, baked chips, and bite-sized mini cakes cater to urban consumers seeking quick, healthy, and portion-controlled options. |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5493

Bakery Product Market Regional Analysis

Europe Dominated the Bakery Product Market in 2024

Europe is considered the hub of bakery products, as the region is both the largest producer and consumer. Items such as breads, biscuits, cookies, cakes, pastries, and a variety of innovative bakery products are consumed daily in the region, driving the bakery product market. The availability of innovative and traditional bakery products further fuels market growth. High demand for healthy bakes, such as gluten-free, whole-wheat, organic, and lower-sugar options, also helps drive market growth. Countries such as Germany, the UK, France, Italy, and Spain play a major role in the growth of the European market.

Asia Pacific Is Expected to Grow in the Forecast Period

Asia Pacific is expected to grow over the forecast period due to factors such as urbanization, rising disposable incomes, and increased demand for healthier alternatives. Growing fast food chains and high demand for bakery items from such food joints have also helped the growth of the bakery product market. Higher demand for healthier bakery products that are low in sugar and available in whole wheat options also helps the growth of the market in the foreseeable period.

Trade Analysis: Global Bakery Products Market

Top Exporters in the Bakery Products Market

European Union (Germany, Netherlands, France, Italy, Spain)

- The European Union dominates global bakery exports, with Germany and the Netherlands leading in biscuits, crackers, and bread products. These countries benefit from advanced manufacturing, strict quality standards, and efficient logistics networks. France and Italy export high-value artisanal bakery items, pastries, and premium biscuits, while Spain and Belgium lead in packaged and private-label baked goods. Intra-EU trade remains robust, and re-exports through the Netherlands and Belgium play a major role in European supply chains.

United States

- The U.S. ranks among the top bakery exporters, shipping cookies, cakes, muffins, and breakfast bakery items across the Americas and Asia-Pacific. U.S. exports are supported by strong brand recognition, extensive distribution networks, and innovation in gluten-free, organic, and protein-enriched baked goods.

China

- China is a growing exporter of packaged bakery products, particularly biscuits, cookies, and sweet pastries. Competitive pricing, improved packaging, and product diversification have helped Chinese bakery manufacturers penetrate emerging markets in Asia, Africa, and the Middle East.

India

- India has rapidly expanded its bakery exports, driven by the popularity of biscuits, cookies, and rusk products. Indian bakery brands are gaining traction in Africa, Southeast Asia, and the Middle East, where price-sensitive consumers prefer affordable and long-shelf-life products.

Mexico and Turkey

- Mexico is a significant exporter of sweet bakery and confectionery items to North and South America, while Turkey leads in exports of biscuits and traditional baked goods to Europe, the Middle East, and Africa.

Top Importers and Demand Centers

North America (United States and Canada)

- North America is a major importer of artisanal bakery products, gourmet breads, and European biscuits. Imports are driven by consumer demand for diversity, premium quality, and ethnic bakery items.

European Union

- Despite being a key exporter, the EU is also a large importer due to intra-regional trade. High-income European countries import specialty baked goods, frozen doughs, and pre-mixes from neighboring member states and international partners.

Asia-Pacific (China, Japan, South Korea, Australia)

- APAC’s demand for bakery imports continues to grow, fueled by urbanization, rising disposable incomes, and Westernization of food habits. Japan and South Korea import premium pastries and ready-to-bake frozen bakery products, while China and Southeast Asia are emerging as strong consumption hubs.

Middle East and Africa

- Countries such as the United Arab Emirates and Saudi Arabia are key importers of packaged bakery products, particularly from Europe and India. Growing populations, tourism, and modern retail expansion continue to support import growth.

Latin America

- Brazil, Chile, and Colombia are increasing imports of high-end bakery ingredients and finished products, driven by the growth of cafés, fast-food chains, and in-store bakery sections in supermarkets.

Bakery Product Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 5.5% |

| Market Size in 2025 | USD 507.46 Billion |

| Market Size in 2026 | USD 535.37 Billion |

| Market Size by 2034 | USD 821.62 Billion |

| Dominated Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Bakery Product Market Segmental Analysis

Product Analysis

The bread segment led the bakery product market in 2024 as it is a staple food in most regions. The product is easily accessible to consumers on different types of retail and e-commerce platforms. Higher demand for organic, only wheat, and multigrain options further fuels the growth of the market. High fiber and protein options are also demanded by consumers, further fueling the growth of the market.

The biscuit and cookies segment is expected to grow in the foreseeable period as they are another highly demanded bakery option by consumers of different age groups. Gluten-free, less sugar, no sugar, and wheat-free options in biscuits and cookies further fuel the growth of the bakery product market. Protein and multigrain cookies, high in demand by health-conscious consumers, also help to elevate the growth of the market. Hence, the segment has a major role in the growth of the market in the foreseeable period.

Distribution Channel Analysis

The supermarket and hypermarket segment led the bakery product market in 2024 due to the easy availability of different types of bakery products in such stores. Such markets are easily available near residential areas and are highly accessible for consumers. Consumers can search for different types of healthy and flavor options in such stores where products are stacked in different categories for their convenience. Hence, the segment had a major role in the growth of the market.

The convenience stores segment is expected to grow in the foreseen period due to easy availability of such stores near residential areas, making it convenient for consumers to shop for the required bakery product. Such stores have a variety of fresh bakery products, allowing consumers to shop for healthy and flavorful products. Hence, the segment has a major role in the growth of the market in the foreseeable period.

Product Range Analysis

The conventional segment dominated the market in 2024 due to the easy availability of such stores and the availability of different types of products as well. Such types of stores also provide economical options to consumers. Hence, price-conscious consumers prefer shopping in such segments, further fueling market growth. The segment also provides a variety of new and innovative bakery products that are clean-label and healthy, further enhancing the growth of the market. Hence, the segment had a major role in the growth of the bakery product market.

The specialty segment is expected to grow in the forecast period due to the rising population of health-conscious consumers. The segment focuses on providing healthy bakery options such as gluten-free, whole wheat, less-sugar, or no sugar bakery items, further fueling the growth of the market. Availability of healthy cookies, biscuits, and cake options in organic variants as well further helps to accumulate the health-conscious consumers group. Hence, the segment has a major role in the growth of the market in the foreseeable period.

Form Analysis

The fresh segment led the market in 2024 due to high consumption of a few bakery items regularly in the western region. Hence, a few fresh bakes are consumed on a larger scale in the western region, fueling the growth of the bakery product market. Hence, the segment had a major role in the growth of the market in 2024.

The frozen segment is expected to grow in the foreseen period due to its longer shelf life, which helps keep the product preserved for a longer period. Consumers seeking convenient, ready-to-eat bakery products are fueling market growth. Frozen products are also easy to carry and can be consumed easily outdoors. Hence, the segment has a major role in the growth of the market in the foreseeable period.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size increasing from USD 14.25 billion in 2025 and is expected to surpass USD 33.59 billion by 2034, with a projected CAGR of 10% during the forecast period from 2025 to 2034.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 127.88 million in 2025 to USD 332.46 million by 2034, growing at a CAGR of 11.2% throughout the forecast period from 2025 to 2034.

- Plant-Based Protein Market: The global plant-based protein market size is projected to expand from USD 20.33 billion in 2025 and is expected to reach USD 43.07 billion by 2034, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

- Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

Top Companies in the Bakery Product Market

- Grupo Bimbo: Grupo Bimbo is the world’s largest bakery company, operating across 30+ countries with brands like Sara Lee, Entenmann’s, and Oroweat. Its extensive portfolio spans packaged breads, cakes, and sweet baked goods. Bimbo’s focus on sustainability, automation, and plant-based innovation solidifies its global leadership in industrial and packaged bakery production.

- Mondelez International: Mondelez leads the global sweet bakery and biscuit segment through powerhouse brands such as Oreo, BelVita, and Chips Ahoy!. The company emphasizes snacking innovation, portion control, and better-for-you product lines. Its global reach and investment in data-driven consumer insights strengthen its competitive edge in the bakery snacks market.

- General Mills: General Mills commands a strong market presence with brands like Pillsbury, Betty Crocker, and Nature Valley, offering baking mixes, pastries, and refrigerated doughs. Its innovation in gluten-free and natural ingredient-based products supports health-conscious consumer demand, while digital engagement drives brand loyalty worldwide.

- Nestlé S.A.: Nestlé’s bakery offerings, including Toll House and KitKat, blend indulgence with nutrition. Leveraging its R&D leadership and culinary expertise, Nestlé focuses on reformulating products with cleaner labels, balanced nutrition, and sustainable ingredients to align with evolving consumer preferences.

- Associated British Foods (ABF): ABF’s bakery division, including Allied Bakeries and Kingsmill, integrates flour milling, ingredients manufacturing, and industrial baking under one supply chain. The company’s operational scale and vertical integration enhance efficiency and consistency across Europe’s packaged bread and baked goods market.

- Aryzta AG: Aryzta specializes in frozen and ready-to-bake bakery products for retail, foodservice, and quick-service restaurants. Its portfolio includes artisan breads, pastries, and cookies. The company’s strong distribution partnerships and innovation in frozen bakery technology make it a leader in convenience-driven baked goods.

- Campbell Soup Company: Through its Pepperidge Farm brand, Campbell Soup Company offers cookies, breads, and frozen bakery snacks emphasizing wholesome ingredients and portion-controlled indulgence. Its premium positioning and brand heritage make it a key player in North America’s baked snacks category.

- Conagra Brands: Conagra operates in the bakery segment through brands like Duncan Hines and Marie Callender’s, focusing on frozen desserts and baking mixes. The company’s commitment to innovation in convenience-based sweet bakery products aligns with the rising demand for easy-to-prepare indulgent foods.

- Finsbury Food Group: Finsbury Food Group manufactures cakes, breads, and morning goods for retail and foodservice markets in the UK. Its diversified product base, private-label partnerships, and licensed brands drive resilience and flexibility in a competitive regional market.

- Lantmännen Unibake: Lantmännen Unibake is a major European producer of frozen breads, rolls, and pastries for retail and foodservice. The company’s focus on sustainability, traceability, and Scandinavian quality supports its growth across Europe’s premium frozen bakery sector.

- Kellogg Company: Kellogg’s bakery products include Pop-Tarts, Eggo, and Nutri-Grain, targeting the on-the-go breakfast and snack markets. The company combines strong brand equity with continuous product innovation in convenient, fortified, and indulgent bakery snacks.

- Hostess Brands: Hostess Brands, famous for Twinkies and Ding Dongs, specializes in shelf-stable snack cakes and sweet baked goods. The brand’s focus on nostalgia, convenience, and high-margin snacking formats ensures continued strength in North American markets.

-

Yamazaki Baking Co.: Yamazaki is Japan’s largest bakery manufacturer and a global leader in packaged breads, pastries, and confectionery. Known for freshness, local flavor innovation, and production quality, Yamazaki combines traditional craftsmanship with industrial-scale baking technology.

Segments Covered in the Report

By Product Type

- Bread

- Cakes and Pastries

- Biscuits and Cookies

- Other Bakery Products

By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Others

By Product Range

- Specialty

- Gluten-Free

- Organic

- Others

- Conventional

By Form

- Frozen

- Fresh

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5493

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

➡️U.S. Halal Food Market: https://www.towardsfnb.com/insights/us-halal-food-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.